2024 was an unusually drama-free rerun of 2023, with the S&P 500 posting another +20% gain (25% this year). You’d have to go all the way back to the late 90s to find a similar episode. Let’s call that a relatively rare occurrence. Rarer still, the Magnificent Seven (the seven largest stocks, mostly tech) again led the markets higher while contributing more than half of the S&P 500’s yearly gain. An index of their returns rose nearly 50% for the year. The rest of the market posted excellent, if not stellar returns, with the average large cap stock rising almost 13% and small caps trailing just behind, up just over 11%. At the sector level, communications and financials led with returns in excess of 30%, followed closely by consumer discretionary. Tech rose 22%. Healthcare was the big laggard, rising only 2.5% as concerns grew over potential cost containment measures contemplated by the new administration. It was a textbook risk-on year. Equities generally took a breather in the final quarter of 2024 as bond yields rose in response to stronger economic data. The average large stock declined 2% with small caps flattish. However, the Magnificent Seven kept dancing, rising another 10%, pushing the S&P 500 2.4% higher.

The equity market, like water or lightning, finds the easiest path. While a repeat of 2023 wasn’t a statistically likely outcome, it’s sensical given the year’s footnotes. The economy never succumbed to higher rates, earnings exceeded expectations, and as inflation ebbed, the hope that the Fed would begin to loosen interest rate policy materialized. With nothing to sour the mood, stocks took the path of least resistance. And what of the huge contribution from the Magnificent Seven…again? Their revenue, earnings, and cash flow growth rates more than doubled that of the market. Nvidia’s revenues alone will have grown close to $70 billion over 2023’s results. Truly unprecedented. It’s unusual to find the largest businesses outgrowing everything else, but that’s where we find ourselves.

“AMERICANS TUNE OUT” blared the headline in the Drudge Report’s December 26th edition—my go-to for a quick unvarnished news fix. Seems we’re exhausted with politics and have stopped paying attention to the news. Former President, President Elect Trump (it’s a mouthful) won’t take office until January 20th so what’s the point of speculating about what he might do? I get it, but he’s hard to ignore; the man has BIG ideas: tax cuts, deregulation, tariffs, mass deportations, budget slashing, annexing Canada (a joke), buying Greenland (no joke) …Elon Musk (not sure). That’s not your average presidential grocery list. And while the citizenry may have tuned out, markets listen and pass judgement. Stocks initially reacted euphorically to Trump’s election, but as bond yields rose, stocks cooled a bit into the year end. My read? The market believes tax cuts and deregulation are serious priorities; it’s assuming a nuanced approach to the rest. I say that because across-the-board tariffs and mass deportations would be highly disruptive and likely inflationary. You’ll be relieved to hear that I’m not going to hash over the complexity and fragility of global supply chains. And I’ll spare you my two cents on who picks the crops, butchers the meat, trims the trees, builds the houses, and a thousand other jobs native-born Americans don’t want to or can’t do. I’ll just say this: markets aren’t prepared for dogmatic tariff and deportation schemes.

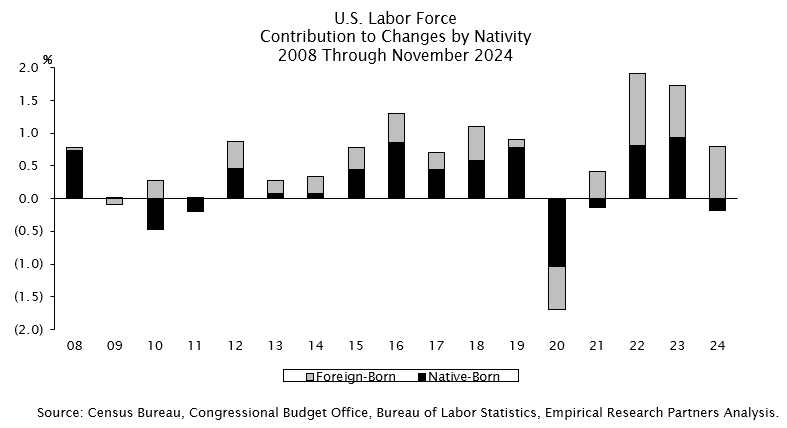

The graph below doesn’t tell the full tale, but we have a structural labor shortage brought on by the aging out of the Boomers. Will we Boomers finally be appreciated? Foreign-born workers (grey shading) are critical to keeping the economy growing and wage inflation manageable. Elon’s robots might eventually take up the slack, but not in the next few years.

What path will markets take in 2025? This imprecise calculus typically incorporates valuation, the economy, earnings growth and Fed policy. Our take: valuation is stretched, the economy is healthy, earnings forecasts are probably too high, but not alarmingly so, and the Fed will be cautious in its actions, meaning a gradual step-down of rates. All else being equal, the valuation element argues for muted returns, especially after the run we’ve enjoyed. This would be normal and healthy.

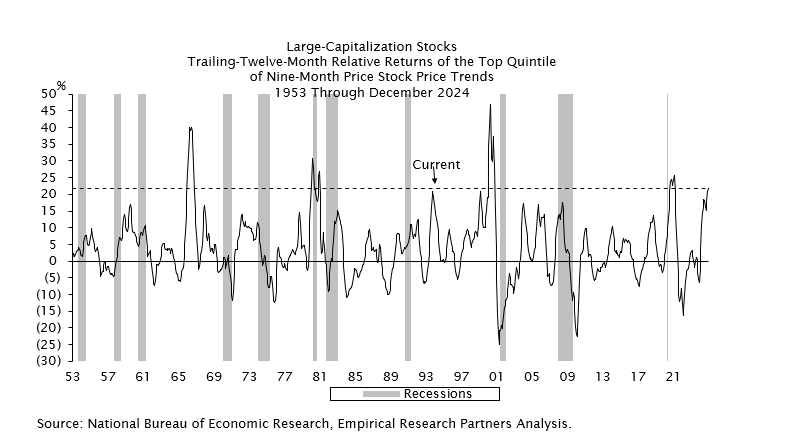

But there is another element at work this year. The graph below represents the relative performance of the best 20% of stocks’ returns. You can think of it as a measure of conviction—how sure investors are that they know they’re right. We call this a momentum measure and as you can see it’s only reached this point six times in the last 70 years. Confidence is very high.

Momentum is most conspicuous in the AI (artificial intelligence) blessed and crypto-related, but it’s also seeped into the financials, and industrial cyclicals. Where the money floods, it eventually ebbs. If the economy keeps its footing and the inevitable surprises remain manageable, there’s a decent chance of a gradual broadening out into other worthy areas of the market. But the probability of a lightning strike is growing as the herd heedlessly crowds into the aforementioned areas. Either way, now is not the time to add to the winners, and some should probably be culled. We’re not negative, but a little rain is overdue and we’re respectful of lightning.

Richard H. Skeppstrom II

Chief Equity Strategist

Richard H. Skeppstrom II serves Brockenbrough as Managing Director and Chief Equity Strategist. He manages two of our investment products and writes most of our investment commentary. Richard joined the firm in 2016 and has 30 years of experience in the investment management industry.

The opinions expressed are those of Brockenbrough*. The opinions referenced are as of the date of publication and are subject to change due to changes in the market of economic conditions and may not necessarily come to pass. Forward looking statements cannot be guaranteed. Brockenbrough is an investment advisor registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Brockenbrough investment advisory services can be found in its Form ADV Part 2, which is available upon request.

*Lowe, Brockenbrough & Co. dba Brockenbrough

It Starts Here

Let’s get to know each other.

Existing Clients

Already part of the family?

4th Quarter 2024 Commentary